자유게시판

Audit Preparation Best Practices

페이지 정보

본문

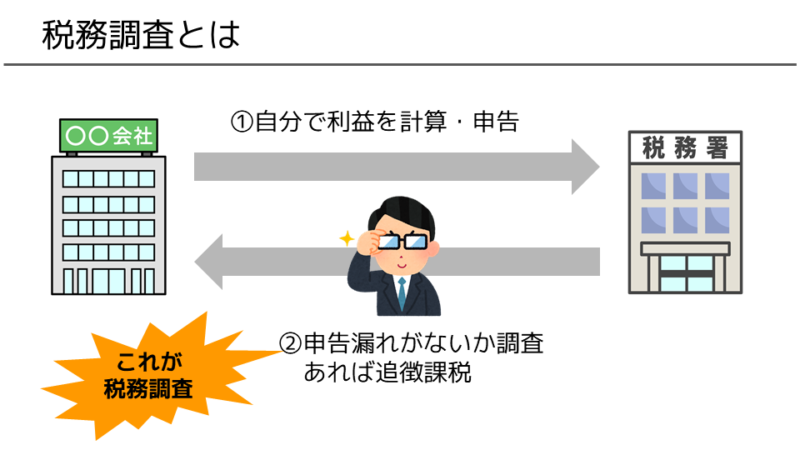

While tax audits can seem like a mechanical, formulaic process, firms missing an organized approach may be caught off guard and experience inordinate financial penalties resulting from any slight incompliance.

Consequently, companies, partnerships, or sole proprietorships should allocate time and resources to create carefully thought-out tax audit planning templates. It is beneficial to prioritize the accounting process before the tax return is due and submission is undertaken. There are key goals to focus on when planning for tax audit. One goal is that of maintaining legitimate and reliable accounting methods, because transparency will definitely make it apparent that any kind of inaccuracies are either due to a lack of technical knowledge and preparation.

Moreover some more elaborate tax audit planning objectives are meant to eliminate unnecessary complications, and safeguard corporate reputation which are the heart-and-soul of business efficiency and stability. Furthermore, the tax audit plan can also be seen to increase audit efficiency with a view to obtaining as expeditiously any tax clearance from the relevant tax bodies. In other cases the preparation of all your audit records also implies creation of systematic policies and methods that can be useful tools to anticipate and to adjust expected auditing practices.

Tax audit implications can have a devastating negative effect on business operations. Overly and chronically irregularities can drastically erode a company's credibility in the eyes of investors, clients, partners, and lastly its employees. Over time any tax liabilities accrued and denied taxes in non-frivolous and genuine ways could push audited entity past its financial thresholds.

Moreover a tax audit entails huge financial liability implications for an entity under examination. For it costs nothing for a business owner to establish the groundwork which makes most of the tax audit successful devoid of unnecessary complications and this is an elementary component contributing to responsible business handling.

In the end, 税務調査 どこまで調べる firms can bypass all sorts of unnecessary complexities and potentially devastating legal problems arising out of tax audit just by possessing a structured tax audit plan and to do all this all seems a justifiable investment of time and human resource.

- 이전글Keep A Conveyor Choosing The Right Conveyor Belting Tools 25.05.14

- 다음글Delta 8 Sour Worms 25.05.14

댓글목록

등록된 댓글이 없습니다.